Anyone who has ever thought about buying a house in Ontario (especially first-time homebuyers) might have noticed an uptick in housing prices in the last decade (even prior to the COVID-19 price explosion). Between 2005 and 2020, the average cost of a house in Ontario increased over $27,000 per year. That might not seem like much, but to put it in perspective, the average household income only increased $1,000 per year during the same period.

The extreme price increase during the COVID-19 pandemic exposed the volatility of the housing market. On the supply side, a variety of factors limited the number of available properties on the market. On the demand side, the combination of more remote work options, coupled with flight from the prohibitively expensive GTA resulted in prices across Ontario nearly doubling from 2020-2022.

I will never forget an article from 2021 entitled “Your House Makes More Than You Do,” which sarcastically noted that home prices in the rural area of Woodstock increased in one year by $118,000 while the average household income was less than $90,000. This may have been amusing for homeowners, but what if you didn’t already own your own house?

This had a profound impact on the rental market, with the average 2-bedroom rental unit in Ontario surging past $2,000 per month in early 2023. Unlike the average housing price, which has been in decline since early 2022, rental prices have not seen the same kind of correction. This had an enormous impact on renters who could barely afford increasing rents, while simultaneously needing to save even more to buy a home due to historically high mortgage rates. While this was a challenge in past years, home ownership has become practically unattainable for first-time homebuyers since the pandemic. It was against this backdrop that the 2022 Ontario Provincial Election was held, and candidates were finally taking notice of the housing situation.

The 2022 Ontario Provincial election was fascinating because for the first time that I can recall, every one of the major parties (Liberals, Progressive Conservatives, NDPs and Greens) not only acknowledged the housing affordability crisis, but also had a plan to address it. This was a major step forward as MPPs acknowledged that the housing market was out of reach for many first-time homebuyers. The sheer importance and timing of the issue inspired LISPOP to develop and deploy a survey during the 2022 election campaign.

In general, the goals of this survey were to capture opinions of voters on the causes, solutions and tradeoffs related to housing policy. In order to compare respondents from different backgrounds as well as control for different variables in our models, a series of demographic and political preference questions were also included. You can peruse the report in its entirety here, but some highlights related to the original question of first-time homeownership will be discussed herein.

A plurality of respondents (23%) who did not currently own their home but wanted to buy had cited housing as their most important issue in the 2022 Provincial election. Among homeowners, a mere 5% believed that housing was the most important issue. One would expect this cleavage to translate over to opinions towards the cause and remedy of the housing crisis.

Many potential causes were viewed similarly by both homeowners and non-homeowners. Some areas of divergence include non-homeowners more stanchly blaming low rent control and low public housing investment. Considering that these respondents are much more likely to be renters and/or living in public housing than homeowners, it is unsurprising that they would be more likely to put the onus on those reasons. Alternatively, low interest rates were viewed as a stronger cause by homeowners, who would be much more experienced with mortgage and interest rate fluctuations than non-homeowners. The most fascinating discussion was surrounding investor speculation, which was a hot button issue for many MPP candidates, especially in the context of property as a foreign investment. It was likewise perceived to be a serious cause by both homeowners and non-homeowners.

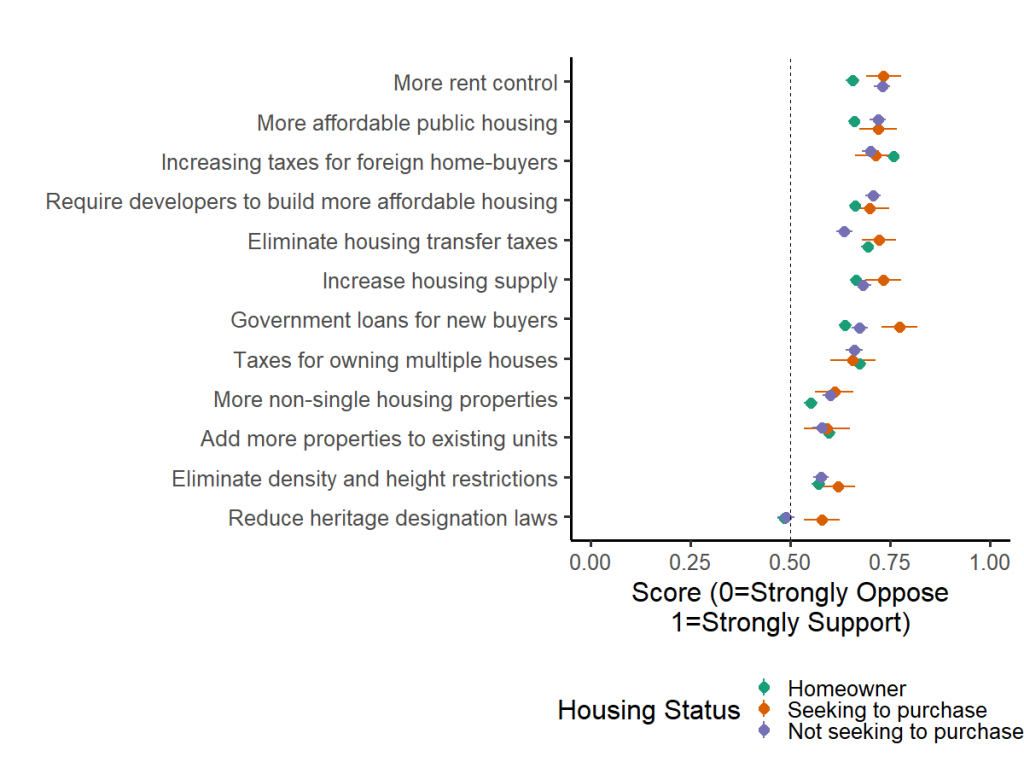

When looking at possible solutions, there’s also a lot of consensuses across the board regardless of housing status. The general idea of “increasing housing supply” seems to be universally accepted, although the implementation seems to be easier said than done. However, there were a few areas that really stand out, including government loans for first-time buyers, which was overwhelmingly supported by those looking to buy. Rent control, also unsurprisingly, is slightly favored by non-homeowners more than homeowners. The most surprising finding was not so much the differences between homeowners and non-homeowners, it was the common ground. I would have expected prospective first-time homebuyers to be clamoring for any change to promote development and reduce housing prices, including taxing foreign home buyers and those that own multiple homes, adding more properties to existing units, eliminating density/height restriction etc., etc.

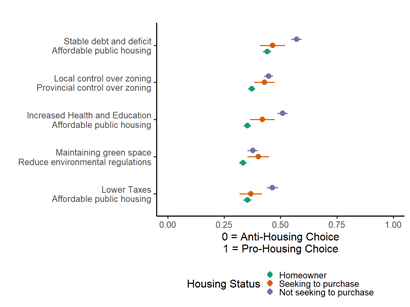

This observation is supported when looking at policy tradeoffs, in which respondents were asked to choose between pro-housing and other policies on a sliding scale. There is barely even 50% support for reducing barriers and/or increasing investment in housing if it results in higher taxes, reduced environmental regulation or deficit spending. Interestingly, respondents who were not in the market seemed to be most in favor of the pro-housing tradeoff option. This might suggest that some non-homeowners may be already locked out of the market, and hence why they are not looking to buy now.

It is quite surprising to see such minor variation between homeowners and non-homeowners, especially among those who are in the market to buy. One would have expected prospective first-time homebuyers to be more in favor of changes that would potentially reduce prices and allow them to achieve their goal of owning a home. Alas, while prospective homeowners are very concerned about housing affordability, this doesn’t translate to an strong position that the government should take drastic action to fix the problem. When a group that would greatly benefit from a change in provincial housing policy doesn’t seem that excited about changing the status quo, it probably won’t.

This was just a snapshot of the findings included in the grey literature report, which is available on our website.